Process Intelligence / Insurance

Optimization of a life insurance product subscription path thanks to Process Intelligence

This insurance and savings company decided to launch a major project to optimize and improve its operational efficiency. And it is in particular on its underwriting process that it decided to work.

The client's challenges and objectives

The underwriting process is the first point of contact with policyholders as it describes the processing of an application for a life insurance policy.

Our client wanted to analyze this process in order to improve it and to respond to several challenges:

1) Multi-level management: different types of actors are involved in the process: front-office (sales people), middle-office (managers) and back-office (the core system).

2) Lack of visibility: this process involves heterogeneous management systems. It is therefore very difficult to map out the actual process performed by the businesses due to the nature of the different business cases of the underwriters.

3) High costs and processing times: the time spent managing underwriting files is significant and can differ from one product to another. This time increases with the number of new contracts, which leads to high processing costs.

4) Compliance and regulations: the insurance industry is highly regulated with major commitments from the insurer on compliance, anti-fraud and anti-money laundering, which can make the process complex and costly

Our achievements

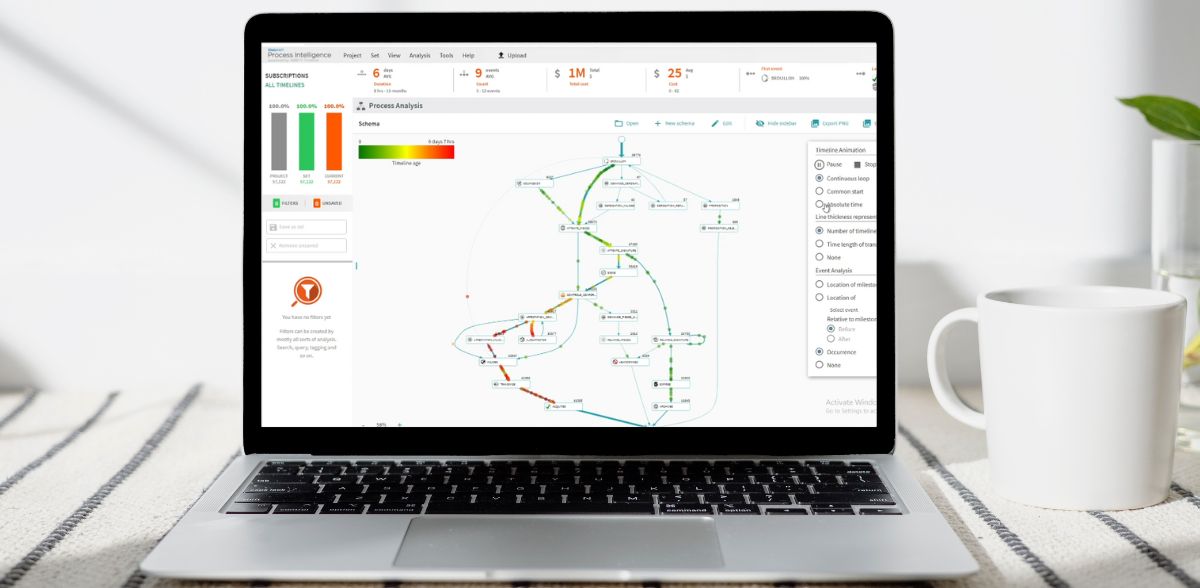

Our client’s challenges were multiple and to meet them we implemented a Process Intelligence tool with ABBYY Timeline.

We were able to analyze and understand the “as it is” processing of the underwriting process as it was. We were then able to identify the points of optimization and the steps eligible for automation, manage alerts of deviations from the “typical process” and monitor the gains in real time.

How did we do it? The ABBYY Timeline tool offers extensive process intelligence modules:

Timeline Analysis: Allows direct inspection of the exact steps performed in each subscription (even when those steps are performed on several different systems). It includes tools to filter by time, complexity, team, subscription type… Access to the execution details of the occurrences allows to have a precise view on the steps and the processing times of the subscription step by step.

13 days is the average time between the creation of a subscription request and its validation

Path Analysis: Provides a visual and interactive way to analyze different execution patterns on all or part of the filtered subscriptions. Deviations are quickly identified from expected behavior or when a step is missed or repeated. Any execution model that represents an interest can be used to directly access the details that exhibit that behavior.

3 path types account for 78% of the subscriptions that resulted in a contract

Protocol Analysis: In addition to Path Analysis, this module allows you to analyze and monitor subscriptions against a “typical” model. The objective is to ensure that the defined process steps are followed for each subscription and to identify any deviation from the prescribed path.

23% of the underwritings follow the “typical process” and 47% follow an optimizable path

Process Query: Provides a simple graphical interface for defining search conditions to find all subscriptions matching any search condition (time, role, sequence, dimension, etc.).

31% of subscriptions in variance are created by sales people

Side-by-side comparison: Provides a detailed analysis of one set of subscriptions compared to another set. It allows to highlight the differences in behavior between two periods, or between two different process flows. For example, the results before and after the optimization of a process.

13% of the subscriptions were received by mail and represent 50% of the overall cost, due to manual creation by our client’s management teams and post-creation validations

Novelis' added value

Our Process Intelligence expertise

Novelis optimizes your company’s performance by leveraging historical, factual and tangible data from your IS. Process Intelligence is a key step in deciding which action plans to implement and prioritizing your operational efficiency improvement projects.

We support our clients in the implementation of process intelligence projects: from the data preparation phase (aggregation, transformation, integration), to the installation of the solution, to the analysis phase. With more than 40 consultants certified on the solution, we have the necessary resources to support you.