How do you determine which stocks to buy, sell, or hold? This is a complex question that requires considering multiple factors: geopolitical events, market trends, company-specific news, and macroeconomic conditions. For individuals or small to medium businesses, taking all these factors into account can be overwhelming. Even large corporations with dedicated financial analysts face challenges due to organizational silos or lack of communication.

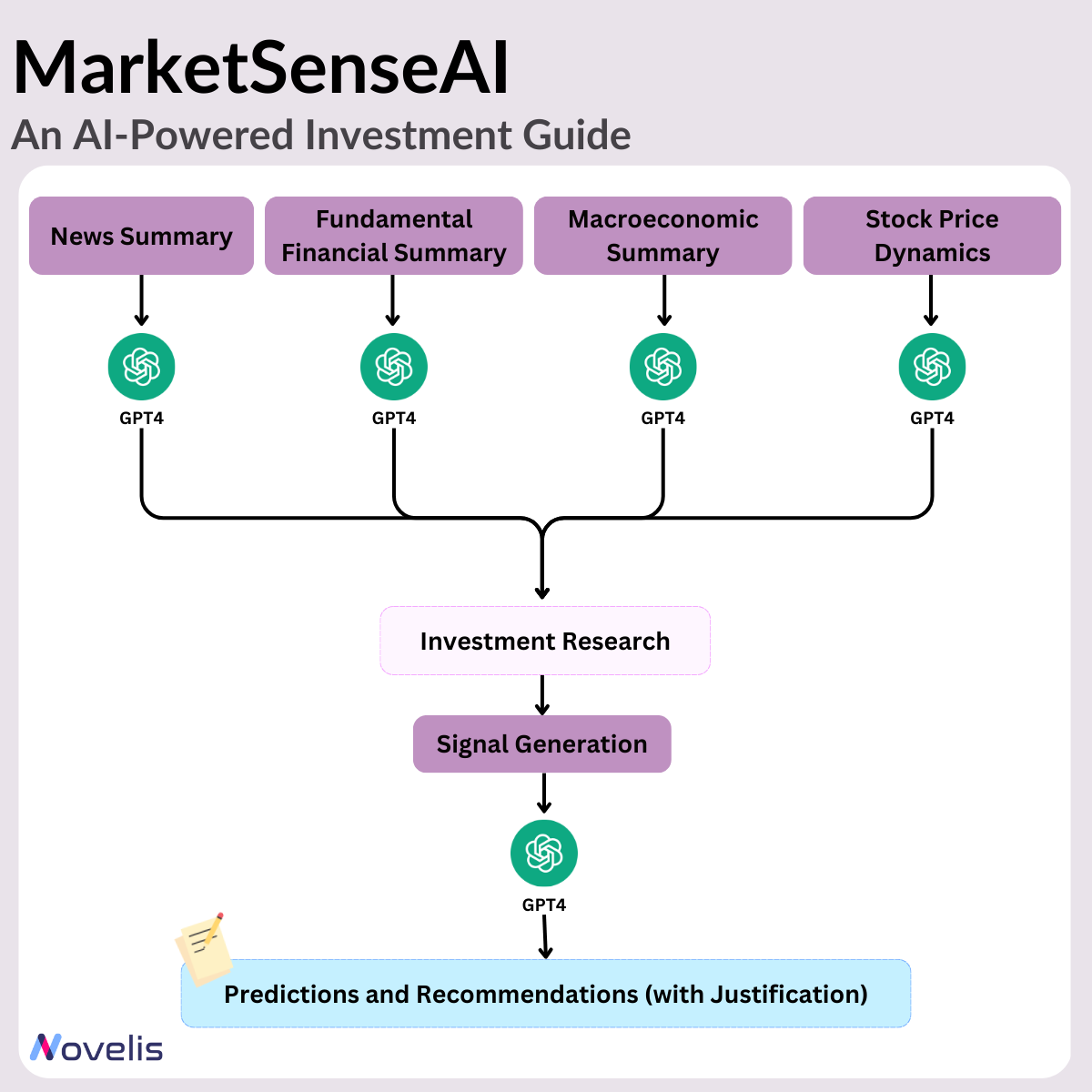

Inspired by the success of GPT-4’s reasoning abilities, researchers from Alpha Tensor Technologies Ltd., the University of Piraeus, and Innov-Acts have developed MarketSenseAI, a GPT-4-based framework designed to assist with stock-related decisions—whether to buy, sell, or hold. MarketSenseAI provides not only predictive capabilities and a signal evaluation mechanism but also explains the rationale behind its recommendations.

The platform is highly customizable to suit an individual’s or company’s risk tolerance, investment plans, and other preferences. It consists of five core modules:

- Progressive News Summary – Summarizes recent developments in the company or sector, alongside past news reports.

- Fundamentals Summary – Analyzes the company’s latest financial statements, providing quantifiable metrics.

- Macroeconomic Summary – Examines the macroeconomic factors influencing the current market environment.

- Stock Price Dynamics – Analyzes the stock’s price movements and trends.

- Signal Generation – Integrates the information from all the modules to deliver a comprehensive investment recommendation for a specific stock, along with a detailed rationale.

This framework serves as a valuable assistant in the decision-making process, empowering investors to make more informed choices. Integrating AI into investment decisions offers several key advantages: it introduces less bias compared to human analysts, efficiently processes large volumes of unstructured data, and identifies patterns, outliers, and discrepancies that traditional analysis might overlook.